Local and national financial advisers share tips for improving money strategies in 2022

For many, the promise of a fresh start of a new year means resolving to take control of personal finances. Whether the desire is to get out of debt, start saving for the future, planning for retirement or shooting for a major purchase like a house, there are ways to clean up one’s credit and get on the road to financial success.

The pandemic has added financial burdens to families, including covering costs for medical expenses, childcare, elder care and other related expenses. Pair that with skyrocketing costs of consumer goods and general inflation, and it’s a recipe for extended debt. The Federal Reserve recently reported revolving consumer credit has crept up past $1.04 trillion—a spike that could indicate more people are turning to credit cards to make ends meet.

Toward the start of the pandemic, the average consumer’s financial outlook wasn’t too bad. Expanded unemployment insurance and loan flexibilities kept families afloat despite rampant loss of income. However, not all people facing hardships received these protection benefits. The Consumer Financial Protection Bureau (CFPB) warns “most pandemic policies—including extended unemployment insurance, eviction moratoria, and mortgage and student loan flexibilities—have recently ended or will end soon. Their expiration may lead to increased consumer distress unless the economic recovery is strong and equitable enough to make up for the loss of protections.”

Women have a more complex financial outlook. The American Association of University Women published its annual disparity study that found women on average make only $0.82 for every dollar a man makes. The barriers are higher for women of color. On average, for every dollar made by white men, white women make roughly $0.79, Black women take home $0.63, Hispanic and/or Latinx women earn $0.55, Asian women make $0.87, Native Hawaiian or Other Pacific Islander women pocket $0.62 and American Indian or Alaska Native women generate just $0.58, according to 2021’s published report. The Center for American Progress study revealed female transgender workers’ earnings dropped by nearly one-third after their gender transitions.

Women also lag behind in retirement savings. Financial research publisher Annuity.org shared that women have smaller retirement savings overall, with an average $57,000 saved, compared to men’s $118,000. That’s not promising data considering savings expectations for a comfortable retirement increased 10% to $1.04 million in 2021.

Fortunately, experts are ready to help clients wrangle their credit woes and course-correct their financial futures. Shauntel Dobbins is the founder of Financially U, LLC, a Cincinnati-based company that provides tools and resources for money management, credit building, asset building and developing skills that identify how behaviors impact money issues. “We are building relationships and partnering with individuals to assist them to establish and maintain healthy relationships with money,” Dobbins says.

Dobbins is particularly motivated to help women achieve financial security. “When I was a single parent, I often felt judged if I did not spend my money properly,” she says. “It was very uncomfortable. I do not want anyone to feel ashamed because they were not taught how to manage their money, so I provide women a nonjudgmental environment so they will feel empowered to have personal financial conversations with the tools and resources that are given.”

It’s never too late to get back on track. Dobbins says one of her biggest success stories is a client who filed Chapter 7 bankruptcy. “I encouraged my client to enter into a credit-building product that allowed her to establish emergency savings while rebuilding her score from 403 to 672.”

Not having emergency savings is one of the most frequent mistakes Dobbins says she sees her clients make. CFPB offers a few tips for increasing that stash for unexpected expenses:

• Start by putting aside what you can afford in order to help cover many common emergencies, such as a car repair or medical bill, that could otherwise become costly debt. Prioritize a dedicated savings account for these unexpected expenses as one of your top savings goals and, as you get a better handle on your overall financial situation, you may decide to set more aside.

• Set guidelines for yourself for when you can spend down this savings fund and what constitutes an emergency, but if you need it, don’t be afraid to use it. That’s what it’s there for. Just remember to work to rebuild it.

• Whether it’s through your bank or employer, there are a number of ways to have money automatically transferred into your savings every week or month. Reoccurring transfers are considered one of the most effective ways to build your savings.

• There may be weeks when money is tighter than others. Take the opportunity to put money into savings when you have it.

• For many Americans, a tax refund can be one of the largest checks they receive all year. Make a plan now to dedicate a portion of that money to saving for some of your larger financial or savings goals.

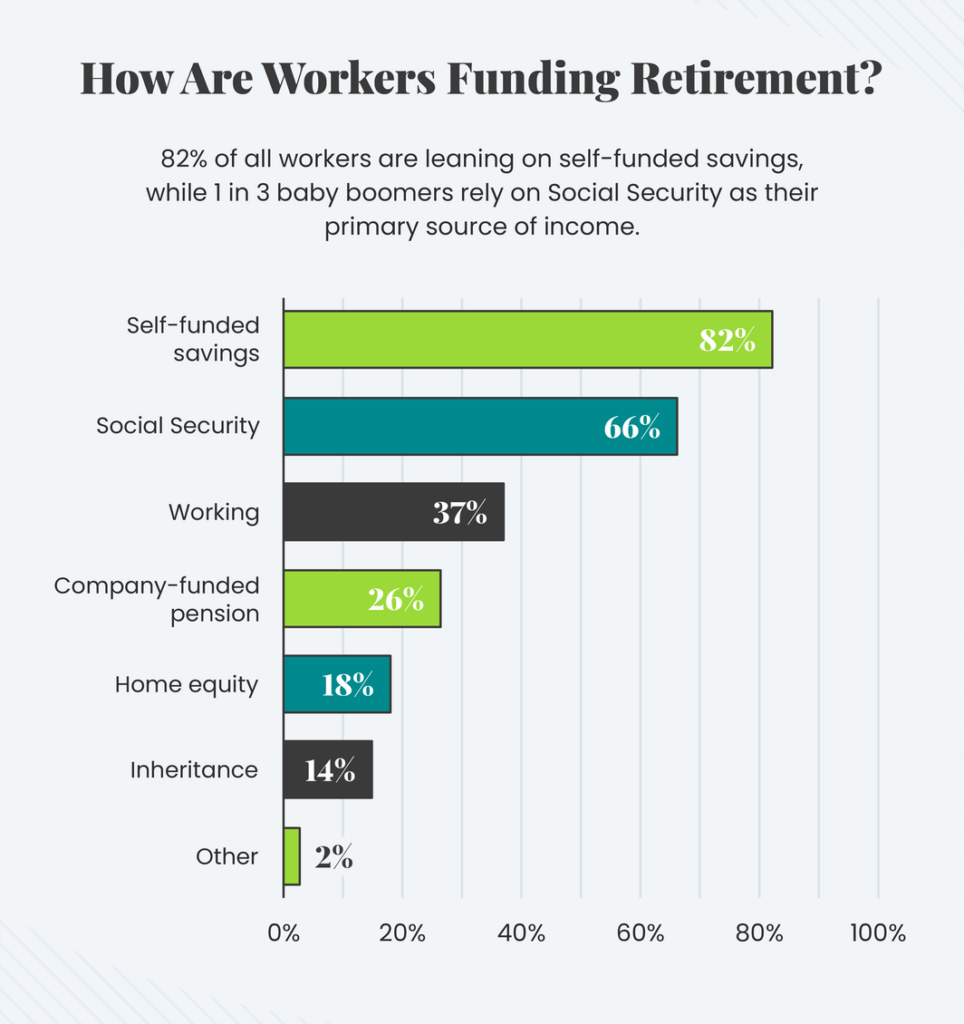

Another common money mishap? Dobbins says not enough workers take advantage of their employers’ retirement programs. Annuity.org reported in 2021 that 72% of workers had access to retirement benefits, but only 56% of workers were enrolled in a plan. Just as automatically scheduling small transfers of money to a savings account can help build up available funds, diverting even a small portion of one’s paycheck can go a long way toward that nest egg. Be sure to ask about whether your employer matches your contributions to your account.

Dobbins has three action items you can do today to start flexing your financial muscles. “Access your free copy of your credit report (I like to use AnnualCreditReport.com); check for accuracy on your credit report (names, addresses and accounts); and dispute errors if you find any on your credit report,” she says.

Most companies you have lending relationships with will work with their customers to resolve disputes, and help create payment programs if their customers fall on hard times. But first you have to ask—before those late or missed payments go to a collections agency. Keeping up with payments—even minimum payments—are important steps to long-term financial security,

Dobbins says. “Thirty-five percent of your credit score formula is based on payments,” she says. “Do your best to make payments, and keep credit card balances low. It is recommended that your credit balances are 30% of your credit limit. Remember a low credit score equals higher interest rates!”